Overview: Global Outlook of the Digital Light Processing (DLP) Projector Industry

The global DLP projector market size is projected to reach USD 5.81 billion in 2024 and grow to USD 8.25 billion by 2029, registering a compound annual growth rate (CAGR) of 7.24% during the forecast period.

As an advanced projection technology based on micro-electromechanical systems (MEMS), DLP (Digital Light Processing) projectors are widely adopted in home entertainment, education, gaming, and digital cinema due to their advantages in image clarity, high contrast, durability, and portability.

Key Drivers of Market Growth

1. High Image Quality and Device Durability:

DLP projectors offer several competitive advantages:

– Superior contrast ratio and color accuracy

– Pixel-free, ultra-clear image quality

– Long lifespan and low maintenance costs

2. Digital Transformation in Entertainment Industry:

– Digital Cinema Shift: The transition from analog to digital screens in theaters accelerates DLP adoption.

– 3D Projection Compatibility: DLP supports high-performance 3D projection, vital for modern cinemas.

– Home Theater Boom: Consumers are increasingly replacing TVs with DLP home projectors for a cinematic experience.

3. Smart Education Driving Demand for DLP Projectors:

The rise of digital classrooms has transformed traditional teaching:

– Government-backed smart classroom initiatives in India, China, and Pakistan

– Enhanced interactivity and accessibility through projection-based learning

Market Trends and Technological Innovations

1. Growing Demand from Home Entertainment and Cinema Segments:

– China: As of 2021, the country had over 82,000 cinema screens.

– Global Cinema: Companies like BARCO, NEC, and Christie lead DLP projector deployments.

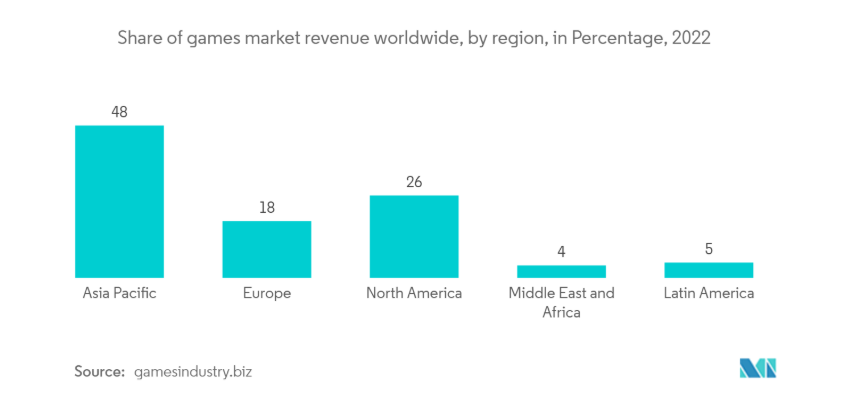

– Gaming Sector: The UK video game market reached GBP 4.66 billion in 2022.

2. Notable Product Innovations:

– ViewSonic: X2000B-4K and X2000L-4K 4K laser UST projectors

– Panasonic: REQ12 series 4K DLP laser projectors with 12,000 lumens and 240Hz projection

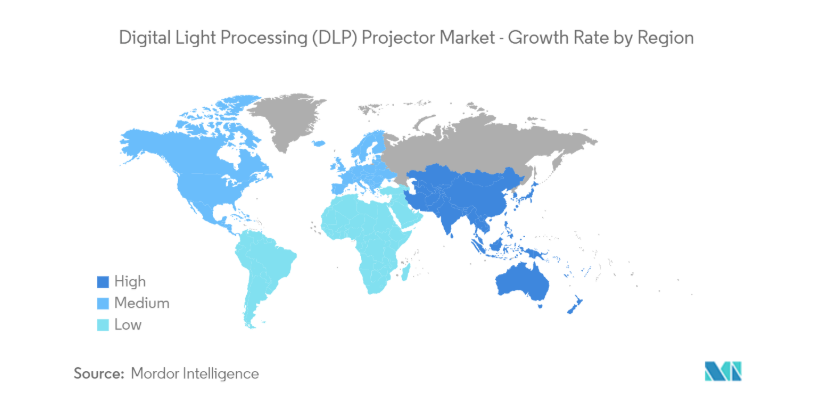

Regional Insights: Asia-Pacific to Witness Strongest Growth

Countries like India, China, and Japan are driving growth due to:

– Expansion of digital education infrastructure

– Surge in home entertainment systems

– Presence of DLP projector manufacturers: BenQ, Sharp, Vivitek, LG, TOUMEI

Key Initiatives:

– Pakistan: 100 smart classrooms across 50 universities

– India: Over 3,000 public classrooms converted to smart classrooms

– Huawei: Smart Classroom 2.0 launched in 2023

Competitive Landscape: Major DLP Projector Manufacturers

The DLP projector industry is fragmented, with leading vendors including:

| Company | Country | Focus Areas |

|---|---|---|

| Optoma | Taiwan | Business & home DLP projectors |

| BenQ | Taiwan | Classroom and home theater projectors |

| ViewSonic | USA | Laser & 4K UST projectors |

| Barco | Belgium | Cinema and professional displays |

| Panasonic | Japan | High-lumen event projection systems |

| TOUMEI | China | Portable DLP projectors & OEM |

Global DLP Projector Market Forecast (2024–2029)

| Year | Market Size (USD Billion) | CAGR |

|---|---|---|

| 2024 | 5.81 | – |

| 2025 | 6.23 | 7.24% |

| 2026 | 6.67 | 7.24% |

| 2027 | 7.15 | 7.24% |

| 2028 | 7.67 | 7.24% |

| 2029 | 8.25 | 7.24% |

Frequently Asked Questions (FAQs)

1. Is a DLP projector good for home theater use?

Yes. DLP projectors offer sharp contrast, vibrant colors, and high resolution—ideal for a cinematic experience at home.

2. What’s the difference between a DLP and an LCD projector?

DLP projectors deliver smoother images with better contrast and less pixelation. LCDs tend to be more affordable but less vibrant.

3. Can DLP projectors connect wirelessly?

Yes. Most modern DLP projectors support Wi-Fi or Bluetooth connectivity.

4. Who are the leading DLP projector brands?

Major brands include Optoma, BenQ, ViewSonic, Barco, Panasonic, and TOUMEI.

5. Are DLP projectors suitable for educational institutions?

Absolutely. Their reliability and brightness make them ideal for smart classroom integration.