In 2025, the domestic projection industry generally faced a market situation of insufficient demand. The intertwining of a slow but continuous shrinkage in traditional market demand with the fact that emerging markets are still in their cultivation stage has magnified the contradiction where basic industry investment cannot be reduced while actual revenue declines. Simultaneously, the global projection market structure is accelerating its “China-fication”: both Chinese-style innovation and Chinese-style “involution” (intense competition) are influencing the global industry, driving the global projection sector into a critical moment of “structural upgrade”.

Demand Side: Weak Market Operation, Difficult Transition Between Old and New Drivers

In 2025, domestic projection demand continued to fall, with the core variable coming from the contraction of the home market. Specifically, entry-level “trial” models priced below 500 RMB experienced a near 50% decline in sales, significantly lowering annual market expectations. Data shows that smart projection, the industry’s sales heavyweight, saw a market contraction of over 10% in the third quarter, while the contraction during the “Double 11” period exceeded 30%. Meanwhile, the education market continued to hover at a low point as the penetration of large-sized LCD interactive devices increased; however, since education is no longer the mainstream application scenario for projection, its impact on overall sales was limited. In terms of meeting and business scenarios, the domestic projection market ended its “rapid replacement by flat panels” cycle and entered the tail end of a relatively slow market replacement phase, with the speed of demand contraction dropping significantly.

Among non-consumer products, the traditional engineering projection field performed relatively well. After facing price-based competition from small-pitch LEDs, the market has essentially entered a stable period. Relying on its unique point-source equipment and protective characteristics for display surfaces, it has secured a foothold in differentiated markets, becoming a “small yet beautiful” sector competing on technical uniqueness.

Regarding new applications, projection technology achieved further breakthroughs in the AR and automotive markets. For example, the installation volume of Huawei-related LCoS-HUDs alone reached nearly 300,000 units, and LCoS technology has become a pioneer for “low-cost popularization” in the AR glasses market. However, AR and automotive HUD projection still face pressure on unit prices, cost-driven competition, and the reality of being in early market stages; with limited total volume, their current pull on the industry’s overall growth is insufficient. Simultaneously, the acceptance of automotive projection headlights by manufacturers is not optimistic due to high prices and a lack of “must-have” urgency. Overall, the demand side of the projection industry in 2025 is characterized by sluggish traditional demand and the inability of new demand to fill the revenue gap.

Technological Innovation: Accelerated Iteration of Core Technologies Laying the Foundation for a New Cycle

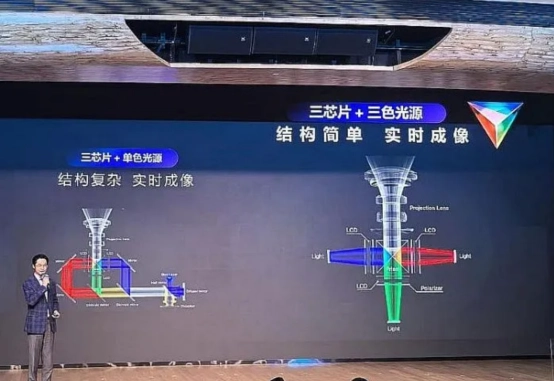

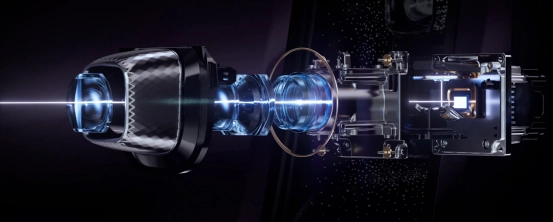

Relative to the “emptiness” of market revenue, 2025 can be described as a “bumper harvest” year for technological iteration across all product lines. Key industry technical progress includes: the 3LCD projection technology introduced a new three-chip/triple-color architecture, with light-recycling technology significantly increasing luminous efficacy; in DLP technology, the micromirror size was updated for the first time in over a decade—the 4.5-micron micromirror DMD chip broke previous records; and Micro LED newcomers revealed their trump card, with the world’s first 4K Micro LED projector (three-chip optical engine and full prototype) achieving a historic “0 to 1” breakthrough.

Furthermore, 2025 marked a milestone for triple-color laser light source technology. The speckle problem, which had constrained triple-color laser technology, was further resolved, with speckle elimination rates reaching as high as 99.999%, filling the final short board. In the application of projection lenses, the combination of short-throw and zoom has become a major trend, offering better compatibility for small spaces.

Supply-Side Philosophy: Projection Returns to Traditional Values

From the perspective of terminal product supply, 2025 was a major upgrade year. The home product market achieved a replacement and iteration of products across almost every price segment, with comprehensive upgrades in brightness, resolution, and light sources. This represents another shift in industry market values: industry research suggests that consumer-grade projection is returning from the “trendy consumption” of previous years toward the traditional “Cinema Culture Consumption” philosophy.

For instance, Xgimi launched the T10 model, bringing professional engineering-grade “light chips” to consumer products for the first time; Epson accelerated its layout of 4K products in the 3,000 RMB price range; and Dangbei fully updated its product lineup with seven new models. In the 1LCD market, product strategies shifted from “competing on low price” to “competing on quality,” with brands like Xiaoming and Xming launching high-performance new products. Data shows that during the “Double 11” period, sales of smart projectors priced above 10,000 RMB exceeded 5,000 units on e-commerce platforms, indicating an inherent demand for “upward quality” in the consumer market.

Manufacturer Growth: Creating New Value Spaces and Breaking Traditional Industry Boundaries

Against the backdrop of intensified stock competition for traditional projection demand, leading companies in 2025 further increased their layouts in new application fields such as automotive and AR. Xgimi Technology participated in exhibitions with disruptive automotive optical solutions, intending to redefine the light and shadow value of automotive spaces through a complete “in-cabin projection + exterior smart headlights” solution; as of March 2025, it had secured 10 automotive project appointments. Appotronics also launched the industry’s first “LCoS+PVG waveguide” AR glasses optical solution and signed purchase orders, while its laser full-color optical lighting products were applied at the National Games.

Industry experts believe that automotive and AR represent the future “Blue Ocean” for projection optics, with potential markets far exceeding traditional projection. Although these new scenarios’ increments cannot yet support the growth performance of traditional projection companies in the short term, the massive potential for growth remains worth anticipating.

Global Layout: Local Projection Enterprises Upgrade Further in the Global Market

In 2025, the path for domestic projection industries to go global faced a more defined new situation, entering the “deep water zone”. This is characterized by high-level competition for quality and branded products replacing the simple export of cost-effective and capacity-based products. For example, Xgimi’s annual flagship T10 was first released in overseas markets at a price higher than in China, representing the increased global discourse power of domestic smart projection’s high-quality imaging capabilities. The export of low-end products did not slow down; Shenzhen manufacturers like Magcubic absorbed domestic technical progress to become the preferred choice for global entry-level products. Meanwhile, TV brands like TCL and Hisense continued to exert influence. Hangzhou Roleds Technology’s outdoor distributed naked-eye 3D projector even won the German Red Dot Award.

From the distribution of export markets, Europe and the US remain the most important centers, but Asia, Africa, Latin America, “Belt and Road” countries, and the Middle East are becoming major sources of growth. The rollout of the first projector from Xgimi’s Vietnam production base marks a new chapter in the global layout of China’s projection industry, moving from “overseas markets” to “overseas bases”.

Competitive Logic: The Pulling Power of Low Prices Declines Rapidly; Value Competition Officially Becomes the Main Line

The development logic of “the cheaper it is, the better it sells,” which deeply influenced the domestic projection industry from 2018 to 2024, was completely overturned in the second half of 2025. “Double 11” data showed that the cheaper the product, the bleaker its market performance, while high-end products saw significant sales increases: triple-color laser product sales grew by over 60%, 4K products by 40%, and zoom products by a staggering 180%.

The core development logic of the projection industry in 2025 underwent a fundamental shift: from past “scale expansion” and “price competition” toward a new stage driven by “Value Cultivation” and “Technical Innovation”. In the third quarter of 2025, the average price of 1LCD models, which dominate the low-price online market, actually rose. The rise in the average price of entry-level consumer projection, running parallel with manufacturers successfully opening up ultra-high-end spaces for 10,000 RMB and 5,000+ lumen products, indicates that the market has abandoned the original “low-price driven” growth model at both the “floor” and “ceiling” levels.

Scenario Expansion: Breaking Application Boundaries Becomes Industry Consensus

In 2025, to enhance product appeal and scenario adaptability, manufacturers broke through application boundaries and significantly increased “creative innovation”. This influence was not limited to consumer projection but also permeated engineering and commercial fields.

For example, Epson products provided “breathing light” differentiated value; Hisense launched rollable laser TVs; Dangbei introduced the industry’s first liquid cooling system; and Samsung launched the Ballie AI projector robot. Additionally, gimbal projectors, “cannon” machines, and zoom lenses became increasingly popular. In engineering and commerce, Roleds’ lightweight naked-eye 3D products integrated high-definition projection with lighting, aiming to drive the transition of lighting products toward “light and shadow”. These application innovations highlight the potential of projection technology in spatial light and shadow control.

Policy Support: Promoting High-Quality Industry Development in Action

In 2025, policy support for the projection industry focused further on consumption and supply upgrades, particularly in “clearing the source”. On one hand, recognition of the CVIA brightness standard increased significantly, becoming the choice for mainstream brands; JD.com launched “JD Brightness Certification” in collaboration with authoritative institutions to eliminate false brightness claims. On the other hand, the new version of “Minimum Allowable Values of Energy Efficiency and Energy Efficiency Grades for Projectors” (GB32028-2025) was released, with significantly higher efficiency requirements. The Level 1 efficiency requirement is approximately 58.1% higher than the highest grade of the old standard, which will better promote high-quality development. Furthermore, the marginal effect of national subsidy policies diminished significantly in 2025 and will no longer be a significant factor affecting the market in the future.

Summary

Despite an overall sluggish domestic projection market in 2025, there was no lack of innovation in technology, standards, applications, and the enrichment of industry consumption culture. Structural changes in market demand forced the entire industry to abandon simple price wars and scale expansion thinking in favor of deepening product value and expanding technical boundaries. Although short-term revenue is under pressure, the series of upgrades revolving around quality, efficiency, and experience is building a more resilient and valuable new foundation for the projection industry’s future. This year is a critical turning point for the industry to achieve a structural upgrade during a low period, laying a solid foundation for healthy and sustainable development in the next stage.

The industry's logic has fundamentally shifted. by 2025, sales of entry-level models under $500 will have declined by nearly 50%, while sales of high-end models above $10,000, as well as 4K and tri-color laser products, will be up against the trend (e.g., 4K products will grow by 40%). the market is shifting from a "war of price" to a "war of value". if you are looking for picture quality, brightness and long-lasting use, now is the time to get your hands on high-end iterations of products that have matured in terms of technology and standards (e.g., compliance with the CVIA Brightness Standard and the new Energy Efficiency Standards).

Tricolor laser is currently the high-end light source technology in the projection industry. 2025, the "scattering" problem that plagued the technology has been historically solved, with a dissipation rate of 99.999%. data show that due to the leap in picture quality experience, the sales of tricolor laser products have increased by more than 60%, and has become the standard light source for high-end smart projection.

Projection is breaking the traditional boundaries and expanding rapidly into the fields of "in-vehicle" and "AR"; for example, the installation volume of in-vehicle LCoS-HUD (Head-Up Display) is approaching 300,000 units, and in-vehicle projection has realized the integrated solution of "in-cabin projection+outdoor smart headlights"; in addition, robot projection with integrated AI interaction (e.g., Samsung Ballie) and outdoor naked-eye 3D projection are also starting to come into the public's view.